Interest groups on both sides of the political aisle are often blamed for government’s ills, including rising budget deficits and debts. But in new research which studies interest group influence in the American states, Thomas T. Holyoke finds that while the number of interest groups in most states is growing, their influence is negative when there is a high level of legislative competition between Republicans and Democrats, and positive when one party is in control. When one party dominates, it turns out, the lack of accountability means that lawmakers are more likely to reward supportive interest groups to keep them loyal.

Interest groups on both sides of the political aisle are often blamed for government’s ills, including rising budget deficits and debts. But in new research which studies interest group influence in the American states, Thomas T. Holyoke finds that while the number of interest groups in most states is growing, their influence is negative when there is a high level of legislative competition between Republicans and Democrats, and positive when one party is in control. When one party dominates, it turns out, the lack of accountability means that lawmakers are more likely to reward supportive interest groups to keep them loyal.

Does interest group lobbying drive-up government spending, leading to debt so large it crushes that government? Given popular sentiment for casting interest groups (such as the National Rifle Association and the American Civil Liberties Union) and lobbyists as the source of all ills and woes in democracies, it would be easy to add run-away spending to the list as well. And there is some evidence that it is true, at least in the American states. But like so much else in politics, it is complicated, and the real blame may rest at the feet of elected officials.

Interest Groups and National Paralysis

Even scholars fear the short and long-term influence of interest groups on democratic nations. A prominent example is the economist Mancur Olson’s 1982 book, The Rise and Decline of Nations, where he warned of the pernicious influence of interest groups on government responsiveness. Representing highly motivated, and often quite wealthy, economic interests, Olson argued that these organized groups wield enough political power to overwhelm elected lawmakers. The result – transfers of most of a nation’s resources into the hands of organizations representing the privileged few at the expense of the many, and indeed of the public good. The long-term consequence is a government unable to invest in the future well-being of society. This ultimately led him to an apocalyptic conclusion, that such nations would ultimately be paralyzed by the special interests, enter a time of decay, and finally collapse. Hence the title of his book.

Public choice economists, and many political scientists, have attempted to test Olson’s prediction using a variety of data on government spending and investment, along with several different measures of interest group numbers and strength in different democratic nations. The results are very mixed. Part of the reason there are contradictory findings may be that it is not clear what measures of state activity are best for such an undertaking. Another reason may be that the political jurisdictions (nations mostly) are not comparable enough to be in the same data set. A finer test is required.

Interest Groups in the American States

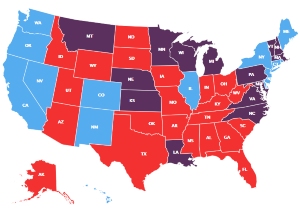

While hardly the definitive study of Olson’s prediction, recent research I conducted alone and with my colleague, Jeff Cummins, have led provides new evidence and insight on how interest group influence may really connect to government activity. The focus is on government spending in the fifty US states. While not sovereign nations, nearly every state government is structured in the same way, making them comparable. Each collects its own revenue through taxes and user fees and passes legislation to spend this revenue of a variety of public or private projects determined by elected officials. Each state also contains its own population of interest groups. Moreover, recent research of mine involving the gathering and cleaning of state interest group data shows that the number of interest groups in most states is growing. Specifically, the number of organized interests in the American states rose from 48,116 in 2006 to 57,001 in 2015, with the biggest increase in Delaware (66 percent) and the smallest in Kentucky (1 percent), no change in some states like Hawaii, and, surprisingly, decreases in a few states like Wyoming (-58 percent). New York had the largest average number of lobbying organizations across this time period at 3,334, followed closely by Florida at 3,307, and California at 3,290.

Photo by Alice Pasqual on Unsplash

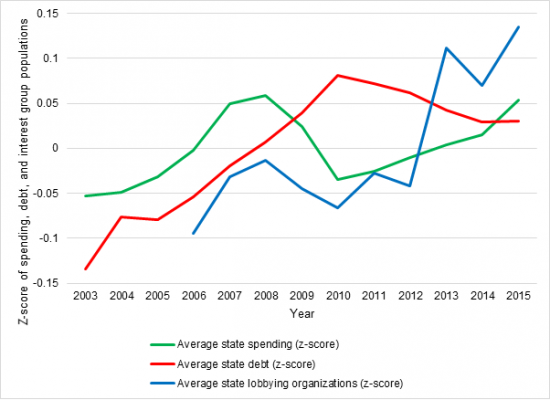

In other research published with my colleague Jeff Cummins of California State University, Fresno, we gathered data on state spending and debt for the same time period. Greater state spending, of course, often leads to greater debt as states find other means of paying their bills in lieu of raising taxes or fees. Spending is frequently demanded by interest groups, who at the same time also lobby hard against greater taxes and fees to compensate state treasuries for that additional spending. Figure 1 below plots the average number of state interest groups, average spending, and average debt. Apart from the dips caused by the Great Recession in 2008, there is a correlation between group numbers, state spending, and debt. Yet the story, as it turns out, is more complicated than this makes it appear.

Figure 1 – Trends in average state spending, state debt, and the number of lobbying organizations

Source: “The Interest Group and Political Party Influence on Growth in State Spending and Debt” in American Politics Research

The Gatekeepers of Interest Group Influence

Interest groups and their lobbyists cannot directly influence state spending; they have no formal power within governing institutions. Only lawmakers can vote to increase or decrease state spending, and therefore the debt that results when they spend beyond their resources. They are the ones through whom group lobbyists try to wield influence. Thus, the motivations of these gatekeepers should also be considered. When would elected officials in state legislatures, where spending decisions are formally made, be most susceptible to interest group influence? We suspected that it might be when lawmakers felt electorally vulnerable, such as when the two political parties are competing for control of state government, which we measure using an index of state party competition.

To our surprise, we find the opposite to be true – the more one party dominates state government, the greater the interest group effect on spending. In other words, if there is no competition between Republicans and Democrats in the state at all for control, then a one standard deviation increase in the number of interest groups lobbying lawmakers leads to a spending increase ranging from 4 to 8 percent. Then when there is considerable competition, with the index set to its highest value, the interest group influence turns negative, actually leading to a spending decrease of approximately 4 percent!

What to make of this? Mancur Olson was not wrong in his apocalyptic prediction regarding interest groups and democratic governance. More groups do lead to more spending on the wants of special interests, leaving less available for other priorities and driving up the kind of public debt that may ultimately crush a state’s ability to fund any public programs and pension systems. It is just that the interest group effect is qualified by the political ambitions of elected officials.

It turns out that it is one party rule that is most dangerous when coupled with interest group strength. Competition among the parties may help impose some degree of fiscal discipline as each party tries to portray itself as the good steward of the public treasury. But when one party dominates, then perhaps hubris and lack of accountability makes it easy for lawmakers in that party to reward supportive interest groups with spending benefits to keep those interests loyal. In other words, it is our elected lawmakers who are ultimately to blame for the decisions to drive up spending, and consequently drive states into crushing debt. It is they who Olson should be concerned about, and who voters in democratic societies should hold accountable.

- This article is based on the papers “Dynamic State Interest Group Systems: A New Look with New Data” in Interest Groups & Advocacy and “The Interest Group and Political Party Influence on Growth in State Spending and Debt” in American Politics Research.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics.

Shortened URL for this post: http://bit.ly/2WbCOkV

About the author

Thomas T. Holyoke – California State University, Fresno

Thomas T. Holyoke – California State University, Fresno

Thomas T. Holyoke is Professor of Political Science at California State University, Fresno. He is a specialist in interest groups and lobbying, as well as education policy and western water policy. He is also the author of the books Competitive Interests: Competition and Compromise in American Interest Groups Politics (Georgetown University Press, 2011), Interest Groups and Lobbying: Pursuing Political Interests in America (Westview Press, 2014), and The Ethical Lobbyist: Reforming Washington’s Influence Industry (Georgetown University Press, 2015).