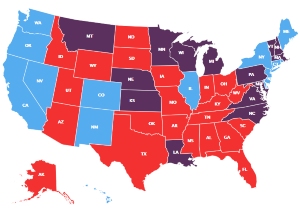

Financialization is more rapid when interested sectors are more active in politics and unions and the Democratic Party are weaker.

The past three decades have seen a rapid increase in the financialization of the American economy, with the financial sector growing in importance to the economy. In new research, Christopher Witko finds that this growth in financialization was not a ‘natural’ economic development, but a consequence of public policy choices that occur when large firms in the FIRE (finance, insurance […]