Dustin Voss of the London School of Economics reviews the European Central Bank’s recent policy reactions to Italy’s government building process. He argues that the glorified imagination of politically neutral central bankers is nothing more than wishful thinking. In fact, it becomes increasingly obvious that the ECB tends to openly embrace punishment by the markets if it is in line with its own views and values.

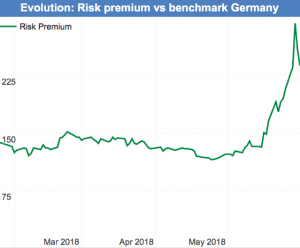

Recently, Italy has been through quite some political turmoil. The results of the parliamentary elections came as nothing less than a ‘political earthquake’ and only after a total of 89 days were the victorious populist parties Cinque Stelle and Lega able to form a new government. In an initial attempt, Italian President Sergio Mattarella had vetoed a cabinet in which the Europhobic economist Paolo Savona was set to become finance minister. In addition to right-wing Lega being decidedly Eurosceptic and particularly opposed to existing migration policies, the new coalition holds for some more substantive changes. In particular, the new parties are determined to put an end to austerity by implementing comprehensive tax reliefs and a pension reform as well as a basic income scheme amounting to a whopping total of €100 Billion in additional expenditure. Unsurprisingly, Italian bond spreads surged significantly in the run-up to the inauguration.

In light of Italy’s political crisis, the European Central Bank (ECB) has come under significant scrutiny with many observers voicing a terrible suspicion: Could the ECB’s market operations be politically motivated?

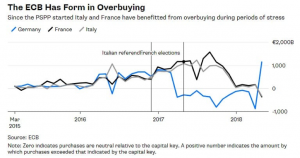

Let’s quickly unpack this: In line with its Public Sector Purchase Programme (PSPP), the ECB is technically obligated to buy sovereign bonds in an amount according to the capital key of member states. Italy’s capital key corresponds to 17.5 per cent. However, during the month of May when Italy’s political crisis reached its peak, the ECB remained with only 14.5 per cent well under the envisioned level. This is quite remarkable for a handful of different reasons. Most importantly, the ECB is well-known to overbuy and exceed capital key requirements in times of political crisis to signal determination and stability to fickle investors. Ever since the implementation of the PSPP, Italy profited in particular from this discretionary procedure. Now suddenly, the ECB seems to change its course.

The central bank justifies its actions pointing to technicalities. With a large pile of maturing German debt, the ECB had to overbuy Bunds and in turn underbuy others.

Never about politics. France, Austria, Belgium also saw share of net purchases fall in May. This is to do with timing of reinvestments (high German redemptions in April and reinvestments had to be spread into May too.) https://t.co/fFDYyRQcDo

— Michael Steen (@michaelsteen) June 4, 2018

However, in an enlightening Bloomberg opinion piece, Marcus Ashworth points out that Italy, too, faced bond maturities. Under business-as-usual, the ECB’s argument might be plausible, but given Italy’s political turmoil and investors’ nervousness, their May strategy was sure to result in a significant surge of interest rates.

So, may it be possible that the glorified political neutrality of central bankers is nothing more than wishful thinking?

Already back in 2001, Thomas Cusack of the Wissenschaftszentrum Berlin argued that central bankers are by no means politically independent. Rather, they tend to share the interests of conservative parties, often times leading to an implicit coalition with the right and the refusal to support centre-left fiscal policy strategies with monetary instruments. Passages in the ECB’s recent Financial Stability Review, as well as top officials’ statements only hours after Italy’s president blessed the new coalition seem to support this view, emphasizing that “A deteriorating growth environment or a loosening of the fiscal stance in high-debt countries could impact the fiscal outlook and, by extension, market sentiment towards some euro area sovereign issuers” and that “Italy should keep within EU rules on its fiscal policy. That’s the message.” Earlier in the lead-up to the Italian elections, European commissioner Günther Oettinger had postulated that the markets would certainly teach Italy’s voters who to support.

The markets and a "darkened" outlook will teach #Italy's voters not to vote for populist parties in the next elections, told me #EU commissioner #Oettinger in my exclusive interview for @dwnews in Strasbourg. "I can only hope that this will play a role in the election campaign." pic.twitter.com/lSYczLYa2U

— Bernd Thomas Riegert (@RiegertBernd) May 29, 2018

Against this background, it shouldn’t be a secret that European officials not only are well aware of the potential influence of markets on democratic opinion making, but also willing to embrace this process when in line with own views and values. Fair enough: in the case of Italy’s current government it is seriously tough to feel pity. But more generally speaking, in times of European stagnation this development leaves an obvious and truly unpleasant question: How is one to design progressive and innovative politics that deviate from business-as-usual, when the ECB is evidently not on your side?

Dustin Voss is an entering PhD student in the European Institute of the London School of Economics.

Featured image credits: Kiefer (CC BY-SA 2.0)