Regulating Investment

- About regulating investment

- Why is regulating investment on the Investment & Human Rights Map?

- Focus areas in regulating investment

- Connecting regulating investment with other activities on the Investment & Human Rights Map

About regulating investment

States compete internationally to attract the presence of international businesses on the premise that their investments can offer a range of positive benefits, including social contributions such as the creation of jobs, the transfer of technology and know-how, the stimulus of research and innovation, and the generation of fiscal revenues to support the provision of public goods and services. The home States of investors also have an interest in supporting and promoting domestic companies to go abroad to drive domestic exports and the growth of domestic enterprises.

However, realising the full range of benefits from investment does not follow automatically. If not managed appropriately, investment can contribute to worsening economic conditions and severe negative impacts on people. Ensuring investment is carried out in a way that does not adversely impact people, and at the same time harnesses the full range of its benefits requires an active process of policymaking. Policymaking includes defining goals and priorities as well as adopting and implementing laws, regulations, administrative processes and promotional activities that translate goals and priorities into concrete action. It can also include the negotiation and implementation of contracts with investors and of international investment agreements (‘IIAs’) with other States. Policymaking therefore has strategic, normative and implementation dimensions at domestic and international levels.

Why is regulating investment on the Investment & Human Rights Map?

The regulation of investment is usually the job of specialised agencies or departments of government. Often focused narrowly on raising levels of investment and trade, or promoting industry or specific sectors, these agencies or departments may not be attuned to the adverse impacts that investment can have on human rights, and they may not be aware of the State’s international human rights obligations. On the other hand, State agencies or departments charged with the implementation of human rights obligations may not actively seek out interaction with those involved in investment policymaking as they do not foresee the relevance of doing so, or they may lack the expertise to engage in investment-related discussions. This can result in investment policies that serve the specific goals and incentives that drive investment-related departments, but that fail to consider, or even work at cross-purposes to, the State’s efforts to pursue their human rights obligations.

The problems stemming from policy incoherence have been highlighted in the UN Guiding Principles on Business and Human Rights (the ‘UNGPs’). Principles 8, 9 and 10 of the UNGPs call on governments to take a broad approach to managing the business and human rights agenda, which includes ensuring policy coherence when pursuing investment-related policy objectives at the domestic and international levels.

There is an urgent need to better understand how State-based policymaking can contribute to better ensuring human rights are protected and respected.

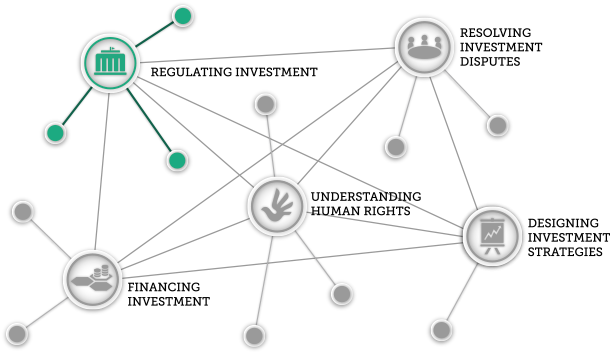

The Investment & Human Rights Map invites targeted consideration of how a number of policymaking areas at the domestic and international levels connect with human rights to better ensure the protection of and respect for human rights, while reaping the full range of social benefits from investment.

Focus areas in regulating investment

The Learning Hub’s work on ‘regulating investment’ will contribute to building understanding of regulation and its relationship to the protection of and respect for human rights in the context of investment by focusing on three areas:

- the policies, laws and regulations that directly promote, enable and protect investment as well as investment-related policy areas such as environmental, labour, property, and corporate law;

- State-investor contracts negotiated and signed by states or state entities and inward investors, which form part of the legal framework for investments, and which implicate the State duties and the investor’s responsibilities to human rights; and

- international investment agreements (‘IIAs’), those treaties [tooltip: treaty means an international agreement concluded between States governed by international law] signed between States to promote and protect foreign investment such as bilateral investment treaties (BITs), Free Trade Agreements (‘FTAs’) and economic partnership agreements with investment provisions.

Connecting regulating investment with other activities on the Investment & Human Rights Map

While these three focus areas constitute the backbone of State policymaking, States also influence and define investment policy when they participate as members of multilateral organisations in the creation of principles, rules, guidelines or other investment-related norms. Two areas are of particular interest:

First, the setting of rules and procedures for the resolution of disputes in fora such as the International Centre for Settlement of Investment Disputes Convention (‘ICSID’) and the United Nations Commission on International Trade Law (‘UNCITRAL’) Arbitration Rules. The pages on ‘Resolving Investment Disputes’ will explore these areas.

Second, the setting of standards of conduct for businesses through initiatives such as the Organisation for Economic Cooperation and Development (‘OECD’) Guidelines for Multinational Enterprises and the International Finance Corporation (‘IFC’) Performance Standards. The pages on ‘Investment-Related Standards’ will explore these and other initiatives.

Finally, while the State is the main regulator of transnational economic activities, it is increasingly common for States to engage in standard-setting with a range of different stakeholders, including industry, non-governmental organisations, labour unions and others. Two examples of this are the Extractive Industry Transparency Initiative and the Voluntary Principles on Security and Human Rights. The pages on ‘Investment-Related Standards’ will also reflect these types of standards.