By Lorenzo Formenti (UNCTAD) and Bruno Casella (UNCTAD)

By Lorenzo Formenti (UNCTAD) and Bruno Casella (UNCTAD)

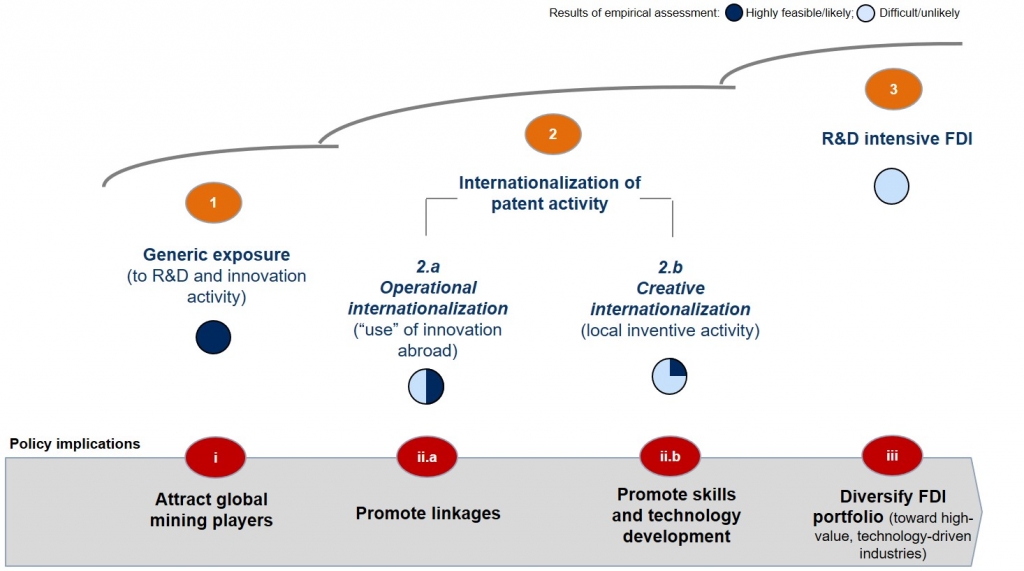

The spillovers of mining FDI – the diffusion and appropriation of foreign technology, know-how or skills that may not be available locally – are paramount for development in poor, resource-rich countries. In this piece, we identify three channels of FDI-led technological spillovers: 1. Generic exposure to multinational R&D activity; 2. Internationalization of patent activity; 3. R&D intensive FDI. We empirically assess each channel and discuss development and policy implications.

Mineral production characteristically lends itself to transnational activity. Foreign direct investment (FDI) has historically played a key role in enabling exploration and extraction activities worldwide, with multinational enterprises (MNEs) their ultimate orchestrators. According to a recent survey we conducted of the 100 largest (publicly-listed) mining corporations, 70 per cent are MNEs and over half of their subsidiaries are foreign-owned (60 per cent). Not only are large mining companies predominantly transnational, but they are more prolific in developing countries than are large MNEs in other industries. Some 35 per cent of foreign affiliates of mining MNEs in UNCTAD’s ranking of the top 100 global MNEs are located in developing economies, half of which in Africa (17 per cent). The share is four times larger than manufacturing and services in the same group, at 5 per cent and 4 per cent respectively. This means mineral-resource FDI is generally indispensable for development.

Some special features mark out mining FDI from other forms of cross-border capital flow. Having specific economic, socio-political, and environmental effects, their impact in host countries has long been the subject of debate in policy circles. In contrast to manufacturing where a narrative has shaped and grown over the technology benefits of FDI attraction, the technological dimension of mining FDI has only been treated tangentially to other topical issues, such as buyer-supplier linkages. This is not surprising. In the mining industry, the hunt for mineral resources has historically been the main driver of foreign investment, leaving little room to manoeuvre for knowledge transfers and technological catch up.

Yet, the spillovers of mining FDI – the diffusion and appropriation of foreign technology, know-how or skills that may not be available locally – are paramount for development in poor, resource-rich countries. While Farole and Winkler (2014) and Ghebrihiwet (2018) have found ambiguous effects associated with licensing and research and development (R&D) collaboration at the country level, no decisive insights are available yet. Our research identifies three channels through which mining FDI can help host countries move up the technology ladder: First, the generic exposure to MNE innovation; second, the internationalization of patent activity – whether passively touching or actively involving local firms and third, R&D intensive FDI. We assess the feasibility of each channel by tracking global trends in the sector:

1) Generic exposure. Against all odds, we found MNEs to be the major source of mining innovation globally, which makes FDI a non-automatic, yet viable way to access key technology assets. Of the top 100 corporate applicants of mining and mining equipment technology and services (METS) patents, 60 are large multinationals, equally split between developed economies and developing and transition economies (30 apiece). Some 60 per cent of applications filed worldwide between 1990 and 2015 belong to MNEs.

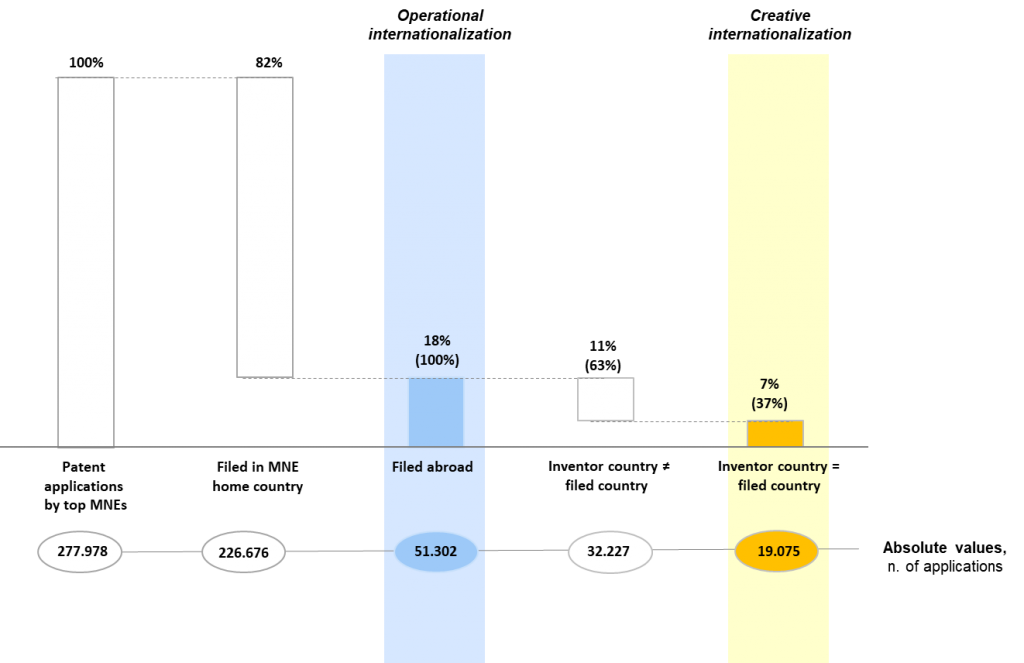

2) Internationalization of patent activity. Interestingly, MNE-owned patents are extensively used and enforced by foreign affiliates in host countries. Of 278,000 applications filed by top MNE applicants between 1990 and 2015, 18 per cent are made in countries other than the parent’s (figure 1).[1] While companies may apply for patents abroad for purely competitive purposes, they pave the way for the operational internalization of technology, i.e. its transfer to third parties via licensing or other non-contractual forms of relationship. More directly, foreign affiliates can also spur local inventive activity by hiring nationals in R&D functions or entering into collaborative R&D with domestic firms. Over a third of foreign applications (37 per cent) list inventors whose nationality coincide with the country of filing. While not automatic, such correspondence gives a strong hint to some forms of MNE-led local innovation being at play in host countries; what we call creative internationalization. Applicant MNEs may not only retain lasting business interests in filing destinations, but also patent inventions resulting from efforts involving locals, within or outside the company walls.

Note: For more details on WIPO Mining Database, see Raffo et al. (2019).

3) R&D intensive FDI. The quest for efficiency and knowledge assets has historically been rare in minerals. Corroborating this tradition, our analysis suggests that conventional motivations, such as access to resource endowments, remain the primary determinants of investment decisions. The bulk of greenfield mining projects kick-started/announced globally between 2007 and 2016 was concentrated in resource extraction (68 per cent), while only a residual portion (32 per cent) involved value-added activities, including sales (14 per cent) and manufacturing (12 per cent). Investment in R&D is scant, comprising only 1.5 per cent of projects. Downstream activities show a similar trend, pointing to the limitations of knowledge-intensive FDI as a vehicle of technology transfer.

Each channel opens a whole new set of challenges for governments to reverse the resource curse in an open economy (figure 2):

i. While the extra costs governments bear in terms of rent-sharing may be important, attracting large global players remains vital. In many cases, MNE entry has not only helped host governments secure investment finance, but also enabled exploration and extraction activities, which would otherwise have been technologically unfeasible. Our research finds that MNEs are the main source of mining and METS patents, a fifth of which are applied in foreign countries. Under the right circumstances, FDI may give MNE suppliers and employees in host countries exposure to state-of-the-art technology and results in the informal transfer of knowledge.

ii.a. As MNEs increasingly source “locally” – and corporate responsibility pressures level the playing field of global business – host country governments should try to tap patent internationalization and tweak local content requirements from a technological standpoint. Indeed, entering into contracts or other forms or relationship with foreign affiliates might not only create new markets, but could also foster “operational” spillovers. Now more than ever policies that promote buyer-supplier linkages should include transfer clauses/options, such as licensing, that enable domestic firms to grasp the technology benefits of matchmaking.

ii.b. Given the pervasive digitalization of the sector, some academics argue anew for mineral resource innovation, emphasizing the potential it holds for suppliers in developing countries. Beyond attracting (the right!) global players, agencies should focus on nurturing skills and the capabilities of domestic firms in a way that makes them attractive business partners. Investment policy should not work in isolation. It should be synergetic with policies that seek to root down inventive MNE activity into the local economy. Policy should shift focus from facilitating spot market transactions to establishing participatory, MNE-led knowledge platforms.

iii. Policy makers should maintain realistic expectations in mining FDI-led technological upgrade. Compared to other industries, cross-border mineral investment frequently fails to seek, mobilize or create cutting-edge knowledge assets. Opportunities for upgrade are therefore limited. While resource extraction should remain central to industrial development strategies in resource-rich host countries, it cannot be relied on solely to build economic prosperity. For that, diversification away from extractives towards greater value addition remains the safest bet.

Notes

[1] By contrast, the share of patents applied abroad by non-MNE top applicants is negligible.

References

This post is based on the book chapter “FDI-led technology spillovers in the mining industry” (provisional), by Bruno Casella (Economics Affairs Officer at UNCTAD) and Lorenzo Formenti (Associate Economic Affairs Officer at UNCTAD), published in: Global Challenges for Innovation and IP in the Mining Industries (Intellectual Property, Innovation and Economic Development series), edited by: Daly A., Humphreys D., Raffo J. and Valacchi G., Cambridge University Press: Cambridge. Forthcoming.

Farole, T. and Winkler D. (2014). Making Foreign Direct Investment Work for Sub-Saharan Africa: Local Spillovers and Competitiveness in Global Value Chains. Directions in Development-Trade;. Washington, DC: World Bank.

Ghebrihiwet N. (2018). FDI technology spillovers in the mining industry: Lessons from South Africa’s mining sector. Resources Policy, 62(1): 463-471.

Raffo J., Daly A. and Valacchi G. (2019). Measuring Innovation in the Mining Industry with Patents. Economic Research Working Paper No. 56. Geneva: World Intellectual Property Organization (WIPO).